Overview

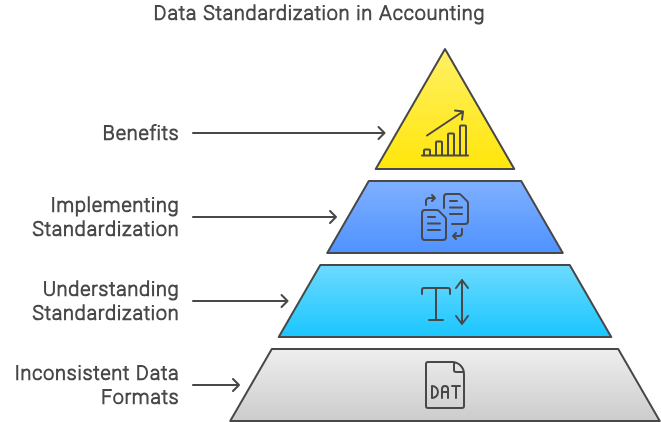

Automating data capture into accounting systems can significantly enhance efficiency and accuracy. However, one of the major challenges encountered is dealing with different data formats, particularly date formats, from various sources such as invoices. This article explores the problem of inconsistent data formats and presents standardization as a solution to ensure seamless integration and processing within accounting systems.

Introduction

In the realm of accounting, automation has become a pivotal tool for streamlining operations and reducing manual errors. Despite its advantages, one of the critical hurdles faced is the inconsistency in data formats. Different vendors and clients may use varying formats for dates, currencies, and other essential data points, leading to complications in data processing and analysis.

The Problem: Inconsistent Data Formats

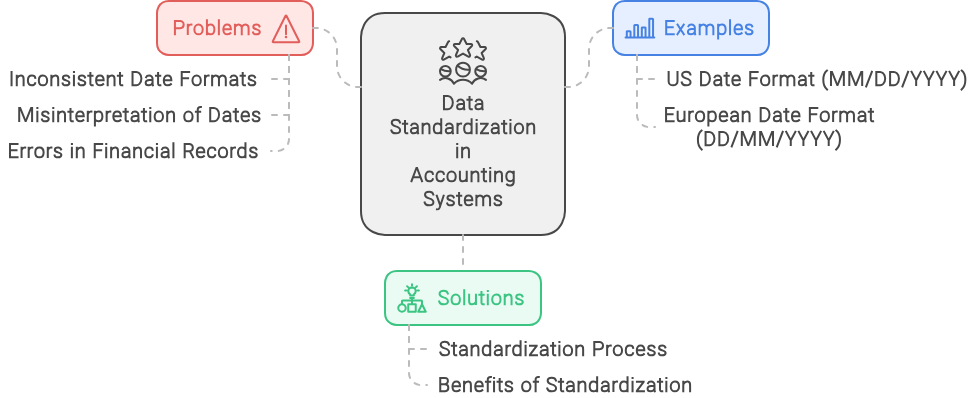

Date Formats

One of the most common issues is the variation in date formats. For example, an invoice from the United States might use the MM/DD/YYYY format, while a European invoice might use the DD/MM/YYYY format. This discrepancy can lead to misinterpretation of dates, causing errors in financial records and reporting.

Problem with automating data capture into an accounting system is dealing with different data formats. One example is different date formats from different invoices. The solution is the ability to standardize the data.

Other Data Formats

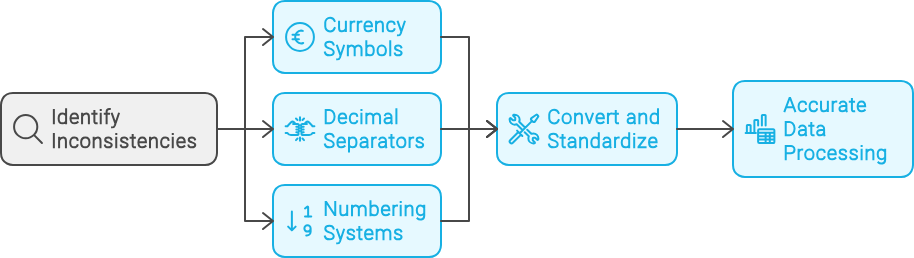

Apart from dates, other data formats such as currency symbols, decimal separators, and numbering systems can also vary. These inconsistencies can complicate the data capture process, requiring additional steps to convert and standardize the data before it can be accurately processed by the accounting system.

The Solution: Data Standardization

Understanding Standardization

Data standardization involves converting data into a common format that can be uniformly processed by the accounting system. This process ensures that all incoming data, regardless of its original format, is transformed into a consistent and recognizable format.

Overview of the 3 costly mistakes to avoid

To streamline data capture processes and maximize efficiency, it is essential to identify and steer clear of these common errors. Let’s delve into the top 5 mistakes to avoid when capturing information from business documents.

Implementing Standardization

- Identify Common Formats: Determine the most commonly used formats for dates, currencies, and other data points within your accounting system.

- Develop Conversion Rules: Create rules and algorithms to convert various formats into the identified common formats. For example, a rule might convert all date formats to YYYY-MM-DD.

- Automate the Conversion Process: Implement automated scripts or software tools that apply these conversion rules to incoming data. This step minimizes manual intervention and reduces the risk of errors.

- Validate and Test: Regularly validate and test the standardized data to ensure accuracy and consistency. This step is crucial to identify and rectify any discrepancies promptly.

Benefits of Standardization

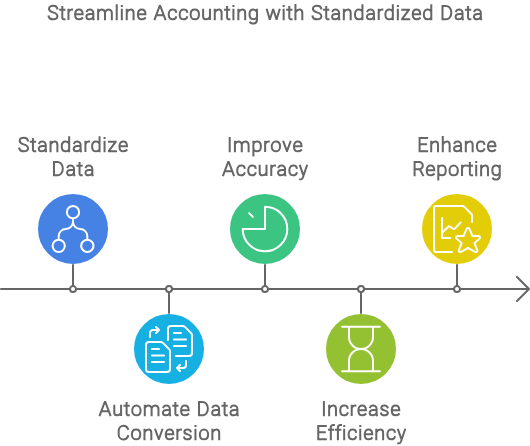

- Improved Accuracy: Standardized data reduces the likelihood of errors caused by misinterpretation of different formats.

- Enhanced Efficiency: Automation of data conversion processes saves time and resources, allowing accounting personnel to focus on more strategic tasks.

- Better Reporting: Consistent data formats facilitate more accurate and reliable financial reporting and analysis.

Conclusion

Dealing with different data formats is a significant challenge in automating data capture into accounting systems. However, by implementing data standardization practices, businesses can overcome this hurdle and ensure seamless integration and processing of data. Standardization not only improves accuracy and efficiency but also enhances the overall reliability of financial records and reporting. As automation continues to evolve, standardization will remain a critical component in optimizing accounting operations.