Overview

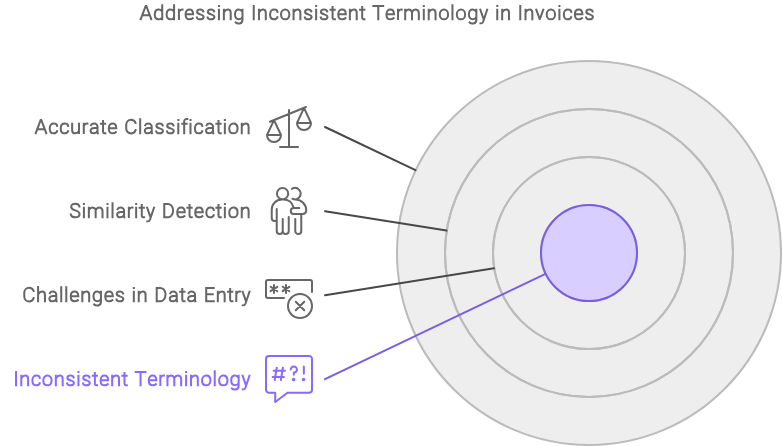

Inconsistent terminology of invoice items from different vendors poses significant challenges for businesses when inputting data into accounting software. This inconsistency, prevalent even within the same industry, can lead to confusion, errors, and incorrect classifications during data entry. To mitigate these issues, implementing Similarity Detection can be an effective solution to identify and classify items accurately.

Introduction

Businesses often deal with multiple vendors, each using their own terminology to describe similar items on invoices. This lack of standardization can create substantial difficulties in maintaining accurate and consistent records. The primary issues include:

- Confusion: Different terms for the same item can confuse data entry personnel.

- Errors: Misinterpretation of terms can lead to incorrect data entry.

- Wrong Classifications: Items may be classified incorrectly, affecting financial reporting and inventory management.

The Problem of Inconsistent Terminology

Industry Variations

Even within the same industry, vendors may use different terms for identical items. For example, in the electronics industry, one vendor might refer to a component as a “resistor,” while another might call it a “resistance.” These variations can complicate the data entry process.

Impact on Businesses

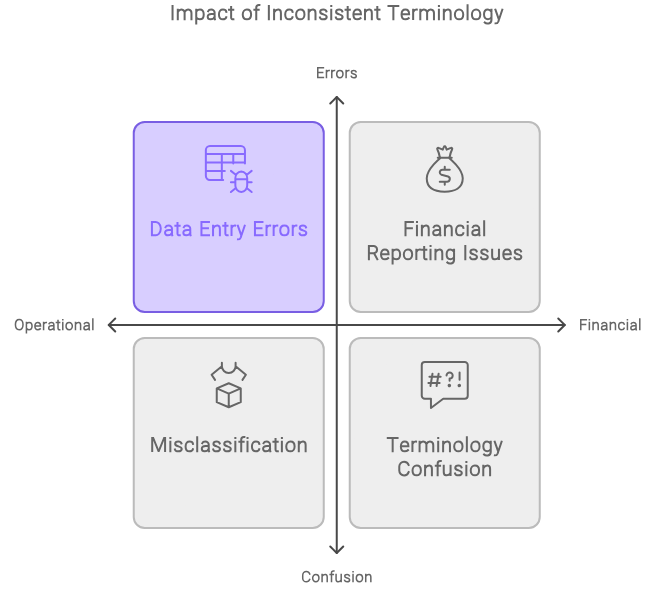

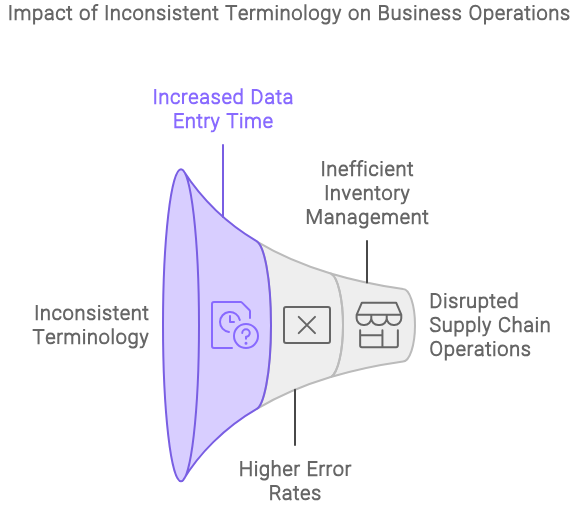

The inconsistency in terminology can have several negative impacts on businesses:

- Increased Data Entry Time: Employees spend more time deciphering and standardizing terms.

- Higher Error Rates: The likelihood of errors increases, leading to potential financial discrepancies.

- Inefficient Inventory Management: Misclassified items can result in inaccurate inventory records, affecting supply chain operations.

Solution: Similarity Detection

What is Similarity Detection?

Similarity Detection is a technique that uses algorithms to identify and classify items based on their similarities, despite differences in terminology. This approach can significantly streamline the data entry process by automatically recognizing and standardizing terms.

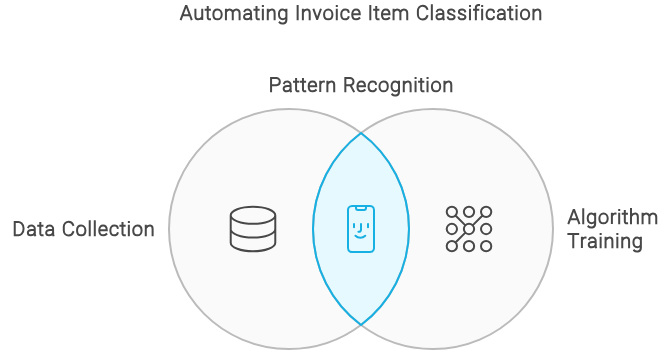

How Similarity Detection Works

- Data Collection: Gather a comprehensive list of terms used by different vendors.

- Algorithm Training: Train machine learning algorithms to recognize patterns and similarities between different terms.

- Implementation: Integrate the trained algorithm into the accounting software to automatically detect and classify items.

Benefits of Similarity Detection

- Reduced Data Entry Time: Automating the recognition of similar items speeds up the data entry process.

- Lower Error Rates: Consistent classification reduces the likelihood of errors.

- Improved Inventory Management: Accurate classification ensures reliable inventory records.

Conclusion

Inconsistent terminology of invoice items from different vendors can create significant challenges for businesses. However, by implementing Similarity Detection, businesses can effectively manage these inconsistencies, leading to more accurate data entry, reduced errors, and improved operational efficiency. Embracing this technology can transform how businesses handle vendor invoices, ensuring consistency and reliability in their accounting processes.

Future Work

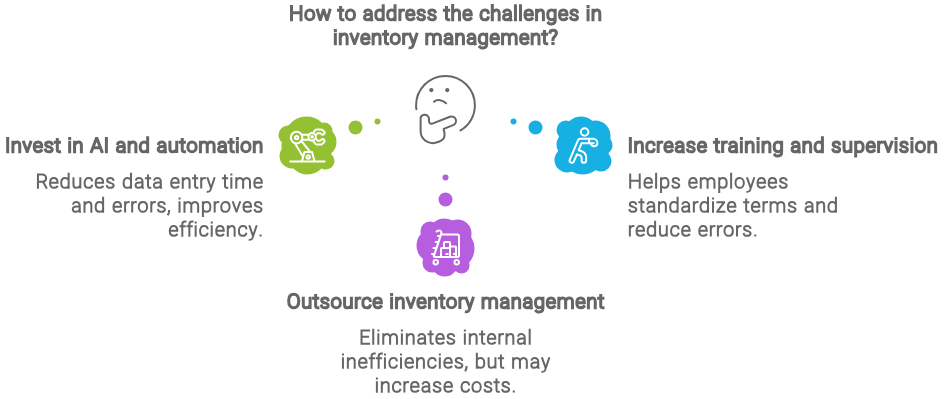

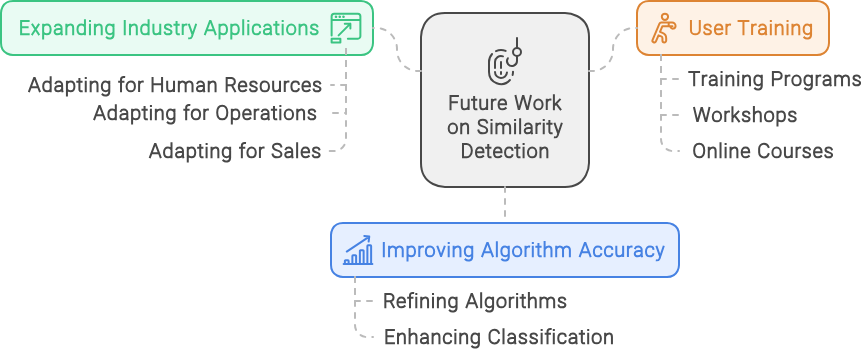

Further research and development can enhance the effectiveness of Similarity Detection algorithms. Future work could focus on:

- Improving Algorithm Accuracy: Continuously refining algorithms to improve accuracy in identifying and classifying items.

- Expanding Industry Applications: Adapting Similarity Detection for use in various industries beyond accounting.

- User Training: Providing training for employees to effectively use and understand the technology.

By addressing these areas, businesses can further optimize their data entry processes and maintain accurate financial records.