Overview

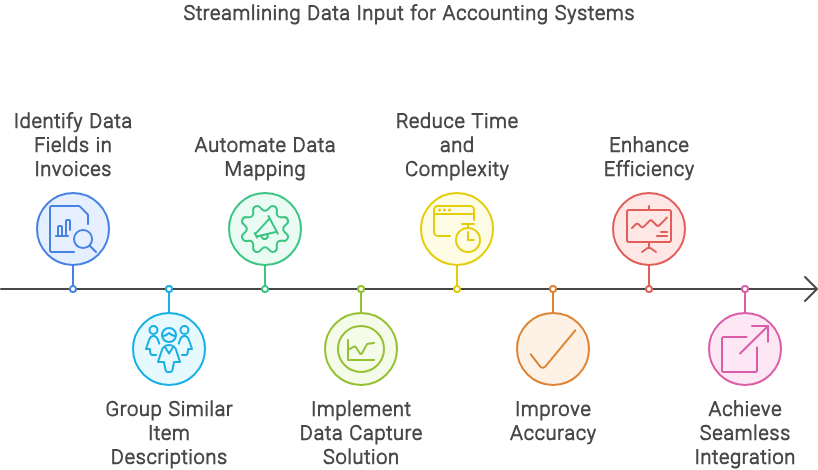

Implementing an automated data capture solution for data input into an accounting system can be a complex and time-consuming process. One of the most tedious tasks is mapping data fields from different invoices to the correct columns in the accounting system. This article explores the challenges associated with this process, particularly the grouping of item descriptions from various invoices, and proposes a solution that leverages the ability to identify and group similar data fields automatically.

Introduction

In the realm of accounting, accurate data entry is crucial for maintaining financial integrity and compliance. However, manual data entry is not only labor-intensive but also prone to errors. Automated data capture solutions offer a way to streamline this process, but they come with their own set of challenges. One significant challenge is the mapping of data fields from different invoices, especially when it comes to item descriptions that may vary in format and terminology.

Challenges in Data Field Mapping

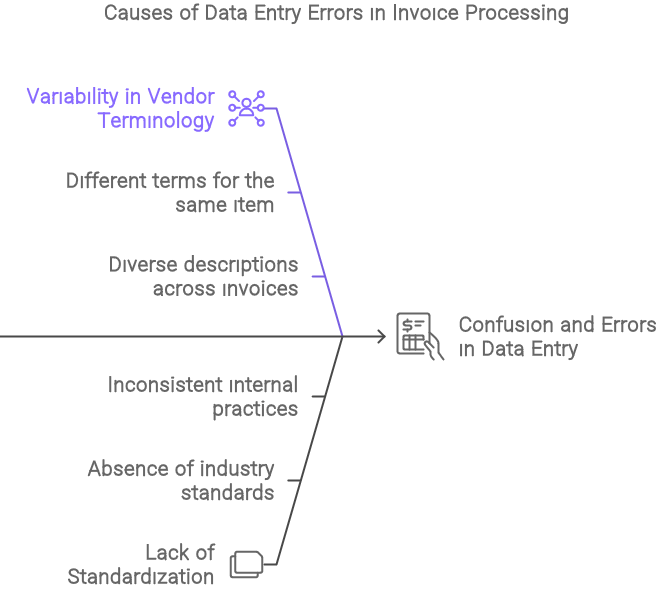

Variability in Invoice Formats

Invoices from different vendors often come in various formats, each with its own structure and terminology. This variability makes it difficult to create a one-size-fits-all solution for data field mapping. For example, one vendor might list an item as “Laptop,” while another might describe the same item as “Portable Computer.”

Inconsistent Terminology

Even within the same industry, different vendors may use different terms to describe the same item. This inconsistency can lead to confusion and errors in data entry if not properly managed.

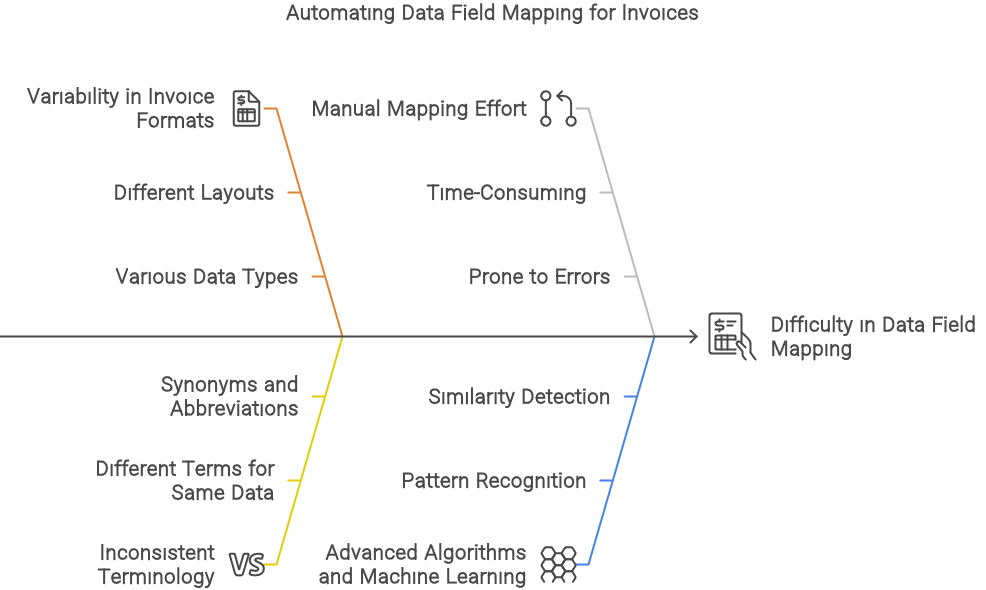

Manual Mapping Effort

Traditionally, mapping data fields from different invoices to the correct columns in an accounting system requires a significant amount of manual effort. This process involves identifying similar data fields, grouping them together, and ensuring they are mapped correctly. This manual effort is not only time-consuming but also increases the risk of human error.

Proposed Solution

Automated Identification of Similar Data Fields

The key to solving the problem of data field mapping lies in the ability to automatically identify similar data fields from different invoices. This can be achieved through the use of advanced algorithms and machine learning techniques that can recognize patterns and similarities in data.

Grouping and Mapping

Once similar data fields have been identified, the next step is to group them together and map them to the correct columns in the accounting system. This can be done using a combination of rule-based and machine learning approaches to ensure accuracy and consistency.

Implementation Steps

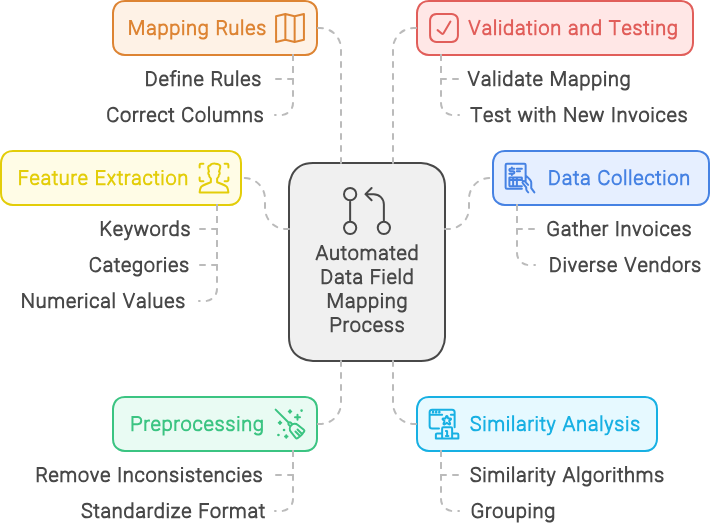

- Data Collection: Gather a diverse set of invoices from different vendors to create a comprehensive dataset.

- Preprocessing: Clean and preprocess the data to remove any inconsistencies and standardize the format.

- Feature Extraction: Extract relevant features from the item descriptions, such as keywords, categories, and numerical values.

- Similarity Analysis: Use algorithms to analyze the similarity between different item descriptions and group them accordingly.

- Mapping Rules: Define rules for mapping grouped item descriptions to the correct columns in the accounting system.

- Validation and Testing: Validate the accuracy of the mapping and test the solution with new invoices to ensure it performs well in real-world scenarios.

Conclusion

Automating the process of mapping data fields from different invoices to the correct columns in an accounting system can significantly reduce the time and effort required for data entry. By leveraging advanced algorithms and machine learning techniques, it is possible to identify and group similar data fields automatically, ensuring accuracy and consistency. This solution not only streamlines the data entry process but also minimizes the risk of errors, ultimately leading to more efficient and reliable accounting practices.

Future Work

Future work could focus on improving the accuracy of the similarity analysis algorithms and expanding the solution to handle a wider range of invoice formats and terminologies. Additionally, integrating the solution with existing accounting systems and workflows could further enhance its usability and effectiveness.